This was the easiest bet on the board.

First, read this genius post that we wrote back in January. It’s about Groupon, the 2011 equivalent of Pets.com or Atari. Unfortunately, there’s no such thing as shorting the stock of a privately held company, or we’d soon be sipping mai tais on the Moon with all the money that we’d have made by predicting Groupon’s demise.

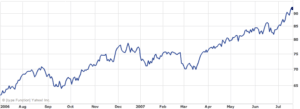

Groupon went public on November 4, finally trading on the New York Stock Exchange after a long courtship period as the new initial public offering darling of the decade. Like LeBron James’ The Decision, only if it was the precursor to a brief honeymoon, followed by an intractable period of anxious consumers waiting patiently and wondering if they’d ever see a return on their investment or if it would crater to zero.

(The 2011-12 NBA season, everyone!)

Six weeks in, Groupon has fallen 10% from its IPO value. The company’s market capitalization is $14.72 billion. That’s more than the market cap of Bed, Bath & Beyond, which is the largest retailer of its kind; a 40-year old company with 1000 stores that actually sells something tangible and turns a healthy profit. Some Groupon stockholders are holding shares in the hopes that someone more naive will eventually take them off their hands. And presumably, some stockholders think Groupon will permanently increase in value and become a blue chip. These people are buffoons.

Groupon went from local (Chicago) player to international media subject last year. The company’s point of differentiation was groundbreaking, and it was hard to believe no one had thought of it before. Unfortunately for Groupon, plenty of people have thought of it since. You can’t patent the concept of temporary mass discounts, thus Groupon has watched its market share get eaten away by Living Social and other competitors; EverSave, GroupBuy, YourBestDeals, and more combinations of everyday words featuring medial capitals.

As if competition from other startups wasn’t enough, part of getting featured in the business media is having established companies take notice and then try to crush you like a bug. AmazonLocal and Google Offers joined the party in the last few months, as did similar sites from AT&T and American Express, each offering a service indistinguishable from Groupon’s. Unlike Groupon, the others can withstand heavy losses.

And lose they do. Last year Groupon took in $713 million in revenue, the most ever for a company so young. If you think that’s impressive, you’ll be equally impressed to discover that there’s a quantity called “expenses” that’s exactly as important as revenue is.

If you’re unfamiliar, which many people seem to be, here’s how Groupon works in two sentences. Its sales staff hits up a local business, promising it a minimum number of customers if the company temporarily offers a huge discount on some item (a “group coupon”, if you will.) Customers download the coupon from Groupon.com, the catch being that the promised minimum number of customers have to download the coupon or the discount won’t activate.

Sounds great in theory. Why doesn’t it work in practice?

To be kind, most of the businesses aren’t what you’d call sophisticated. Plenty of them refuse to do the math and end up giving away the store, and those are the ones for whom Groupon works best. (As for those businesses which Groupon doesn’t create any new customers for, if no one wants your discounted product via Groupon, at least it didn’t cost you anything to discover that.)

Continuing with our sexist observations, visit Groupon.com and see what most of the deals are for. Spa treatments. Hair coloring. Tapas.

(Aside: Here’s advice for anyone looking to enter the retail business. Sell a product that only men buy. Time is money, and you’ll reduce expenses on every sale. Men, or at least all the men you’d want to associate with, don’t bog down the process with an endless series of questions. They pays their money and they gets out. Meanwhile, most women can’t make it to the counter without seeing how long they can make the transaction last. “Is this low-fat?” “What’s your return policy?” “Didn’t you have this on sale last week?” “Was it made in a factory where they have peanuts?” “Are these ‘blood’ diamonds?” “Will this shrink if I put it in the dryer?” [Read the freaking label.])

What does a merchant learn by partnering with Groupon? More than anything else, where to find the price-sensitive buyers. Which is to say, the worst customers imaginable. The ones who will be loyal to your brand only if you continue to provide the best loss leaders.

Groupon is advertising, not sales. Not that there’s anything wrong with the former, but it should always be secondary to the latter. Remember that next time you invest in a company with negative earnings and a business model that’s easy to copy.