And we never will be.

This site isn’t “a place where you can share your thoughts freely on all things personal finance related,” or “a daily recap of our struggle with debt,” or any of that crap. If that’s what you’re looking for, God knows it’s out there and not difficult to find. Commiserate somewhere else. If you’re not here to get rich, get lost.

Because for our purposes, and hopefully for yours, building wealth is all that matters. We’ll even make the argument that building wealth is the highest possible worldly endeavor. The more you make, then the more highly the marketplace of consumers has valued the goods and services you’ve chosen to create. Though that money can buy you stuff, more importantly (to quote one sharp thinker) it can buy you the most precious commodity there is: time. All the other activities that people prioritize – reproducing, being kind to animals, taking a bus to Washington so you can stand outside the Supreme Court with a placard telling passersby your opinion on homosexual marriage – is swell once you’ve got your financial house in order. Until then, Matthew 7:3-5. Take care of your own business first.

Grandiose ideas (and even ordinary ideas) undertaken while suffering from negative net worth almost never materialize.

Sure, J.K. Rowling wrote her first book as a single welfare mother. Good for her. Thousands upon thousands of other aspiring writers wrote their first (and only) manuscripts while on welfare, and never came close to selling them. Or they gave up halfway through Chapter 2. Or they never got beyond the outline stage. But regardless of where those failures ended up, what does it prove to cite the one example who beat historically long odds? What moron makes the argument “That person succeeded as a 100-million-to-1 shot, so I can too”? Isn’t it infinitely better to undertake a path where success is likely, or at least not exceedingly unlikely?

Most personal finance sites love to share first-person stories. Here are some pictures of my new wedding dress and a sidebar about how much it cost me.

I had a ton of consumer debt at the start of the month, but now I have 1998 pounds of consumer debt. I think I’m doing an awesome job, and will punctuate that assessment with an exclamation point!

Now it’s time for 800 words on how I bought discount school supplies for my kids. Oh, and you should look at price tags before you buy things. In my opinion, the smaller the number, the better it is for you.

These people aren’t true personal finance bloggers. They’re merely diarists, interested more in the catharsis of getting their small thoughts down in a semi-permanent form than in writing anything interesting, entertaining, or beneficial. Besides, Samuel Pepys already perfected that literary form 350 years ago.

They’re all idiots, every one of them. (We listed most of the exceptions here. Late addenda: 101 Centavos and Hull Financial Planning. Oh, and Reach Financial Independence.) The grad student with $90,000 in tuition loans but a $1,000 “emergency fund.” The aspiring filmmaker who moves his family around the globe from rental home to rental home, cranking out kids he can’t afford while telling you that selling your excess stuff on eBay is the surest path to riches, and who then finally gives up and hands the blog over to someone in even worse financial shape. The pseudonymous Credit Suisse trader, since fired, who brags about living the baller lifestyle while downsizing his home and trying to convince others that there’s no such thing as a bad financial decision if your heart tells you so.

What makes us different? We know what we’re talking about. We already made the (minimal and non-catastrophic) mistakes, saving you the trouble of repeating them. Unless you want to repeat them, in which case knock yourself out. We’ve also enjoyed the successes, which we experienced largely because we knew how to capitalize on them when we saw them a-coming.

That’s also an indirect explanation of why we don’t take comments. First, 99% of commenters (not just on personal finance sites, but on the internet in toto) have nothing to say. Second, we’re not here to facilitate dialogue. It’s a monologue, and you’re the listeners. For the most part, anything posted as a response in a publicly viewable forum isn’t worth repeating. If you want to talk to us, send us an email or a tweet.

Why do we insist on forbidding comments, which runs counter to almost every other site in the universe? For an answer, take an important subject we have little proficiency in: for instance, medicine. Who are we to go to the WebMD entry on diabetes mellitus and offer our subjective opinions on insulin therapy and high-fiber diets? The licensed professionals who wrote the article aren’t interested, and the WebMD readers shouldn’t be, either. Or we could just write “Awesome post!” in a flawless impersonation of any of the awful personal finance bloggers we referenced above, who leave comments only to microscopically improve their own sites’ Google PageRank.

Look. You want to get rich but have no idea where to start? Here’s a list of criteria neither necessary nor sufficient to build wealth:

- A college education

- Legacy money

- Upward corporate mobility

- The ability to be the last one out of the office every day and the first one in the next morning.

Here’s what will come in handy. Best of all, these are available to anyone. Most of them are practically your birthright:

- Secondary, passive sources of income

- Patience (when it’s warranted)

- Conviction (when patience isn’t warranted)

- The ability to avoid doing moronic things (for an illustration of these, enter “retard” in the search box at the top right of the page)

- Boldness. Not rashness, but rather the confidence to say “Lots of other people are rich. I can do this, even if it means discarding ingrained societal notions of getting a job I’m going to hate and working my way up a ladder I’d just as soon not be on.” In other words, the inverse mindset to obsessing over “What if I lose everything?”

And finally

- The purchase of assets

- The sale of liabilities.

Exercise all those and, we’ll say it again, you’ll get rich in spite of yourself.

Too vague? Here are some specific steps. Eliminate all your consumer debt as quickly as possible, without regard for any short-term pain you’ll incur. Put money aside for growth, not for contingencies. Contribute the maximum to your 401(k). Get your employer to match it. Get as little withheld from your checks as possible, so that you can write the IRS a check on April 15 instead of the other way around. (If you don’t know why you want to do that, you really need to read our book.) Get out of that rental you’re living in and get a fixed-rate mortgage. Don’t just buy low and sell high, do so when your feelings are telling you otherwise. Quit drinking. Start your own business. Organize it as a limited liability company. (Again, if you don’t know how to do this, read our book.) Keep and organize your receipts. Buy a 2nd home and rent it out to someone who’s never going to read this paragraph. Don’t waste time on piddly nonsense like selling your DVDs on Craig’s List for a functional wage of 77¢ an hour. Value your time by concentrating on its most lucrative uses – half a day researching car prices can save you thousands before you negotiate. Get a price out of the other party first. Figure out what they’re after and how much they stand to profit vs. how much you do. Walk away if you don’t like a deal. Ignore emotion at every turn.

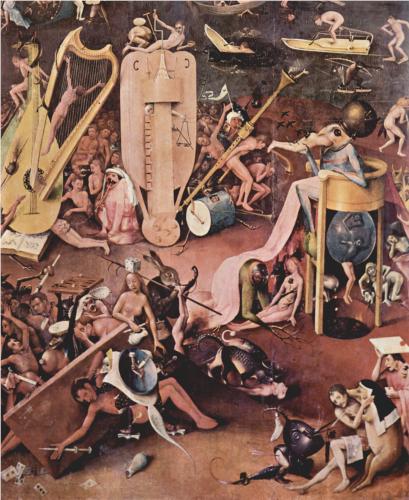

None of those are particularly hard, except for the house-buying one. It’s simply doing this stuff, instead of wallowing in doubt and partaking in the fellowship of the damned, that scares most people off.

And thank God for that, because it makes the path a whole lot less crowded for the rest of us.