Ah, les cigarettes. Ils sont magnifiques!

I think we are inviting God’s judgment on our nation when we shake our fist at Him and say, “We know better than you as to what constitutes a marriage,” and I pray God’s mercy on our generation that has such a prideful, arrogant attitude to think that we have the audacity to define what marriage is about.

(Journalistically abridged version: “Let’s kill all the queers, or at least not serve them.”)

The Chick-Fil-A story came and went, but we’d prefer to take a sober look at its absurdity after a few weeks have passed. People protested, Dan Cathy got assailed, and to the extent that a regional restaurant chain’s management can influence public policy, Chick-Fil-A’s chief operating officer remains committed to the non-marginal belief that marriage is between a man and a woman.

It makes no sense to shun a business because someone said something that hurt your feelings. Your actions either won’t make a difference, or the difference they’ll make will be a negative one.

Take the brief and unspirited Chick-Fil-A protests. What good did they do? That is, what tangible economic benefit did they achieve? How did they make the world a better place?

You could argue that such protests aren’t supposed to provide anyone with an economic benefit, they’re supposed to do the exact opposite to the targeted parties.

But a month later, Dan Cathy is still rich. Say the boycott had worked, to the extent that a few restaurants ended up closing. The company’s franchisees, most of whom have far less money than Mr. Cathy, would have suffered far worse than he. Any affected employees would have suffered even worse. All because a man whom you have no connection with, and who has an extremely modest impact on the crafting of marriage laws, gave his Biblically consistent and majority opinion as to what defines a marriage.

Dan Cathy could have said the Armenian Genocide was The Awesomest Thing Ever and it shouldn’t have made a difference to anybody. The actual business of serving chicken sandwiches isn’t connected to the opinions of the guy in charge.

Legitimate reasons for boycotting Chick-Fil-A:

- They boil chickens alive.

- The secret ingredient in the Polynesian sauce is toxoplasmosis.

- New seasonal pricing – $300 a sandwich.

That’s it. Making a decision based on anything non-galline is part counterproductive, part foolish. And attempting to assess the values of the people in charge is 100% hypocritical. Either that, or every pot smoker who protested Chick-Fil-A must buy exclusively from pro-gay-marriage dealers.

Boycotts temporarily satisfy. (“Delta kept us on the runway for 3 hours. I’m never flying that airline again!”) Three months later, when you need to fly to London and Delta’s prices are hundreds of dollars cheaper than Virgin’s or American’s, your mind will probably change. That being said, almost all of us are guilty of this.

For instance, your humble bloggers refuse to do business with a local Toyota dealership that uses Michael Vick as its spokesman. It’s a 2-person boycott that will have a negligible impact on the dealer’s bottom line. We don’t expect other people to join our passive protest, although we can’t fathom why anyone would patronize a business whose management could have chosen any of 1500 active NFL players to hawk its products yet went with a convicted felon who did to dogs what Josef Mengele did to Jews.

So we established our position. Now, how far should we take it? Should we never buy a Toyota nor a Lexus from anyone anywhere, because how can we do business with a corporation that would grant a dealership to someone who would hire Michael Vick?

That same dealership’s vendors include companies we do business with – a couple of local radio stations, for instance. Should we refuse those companies’ money? If so, what about the radio stations’ vendors; their catering company, for instance? Are 2 degrees of boycott sufficient? How about 3? Where does, or should, it end?

We know a former vegan who quit and reverted to omnivority. Why?

It was too hard. She couldn’t eat beef or pork. Okay, fine. She couldn’t eat chicken. Yes, that’s how herbivority works. She couldn’t eat eggs or fish. The culmination happened when she refused a plate of pasta served with an anchovy sauce. The dish was 1% meat, but that was enough to taint it. At this point her hair had started falling out, and her skin had the pallor of a corpse. (She also smoked cigarettes, reinforcing that her restrictive diet had little connection to health.)

Which brings us to the most profitable company in America, as measured by return on shareholders’ equity. The difference between this company’s assets and its liabilities is $229 million. Which is equivalent to the profit it makes every 10 days.

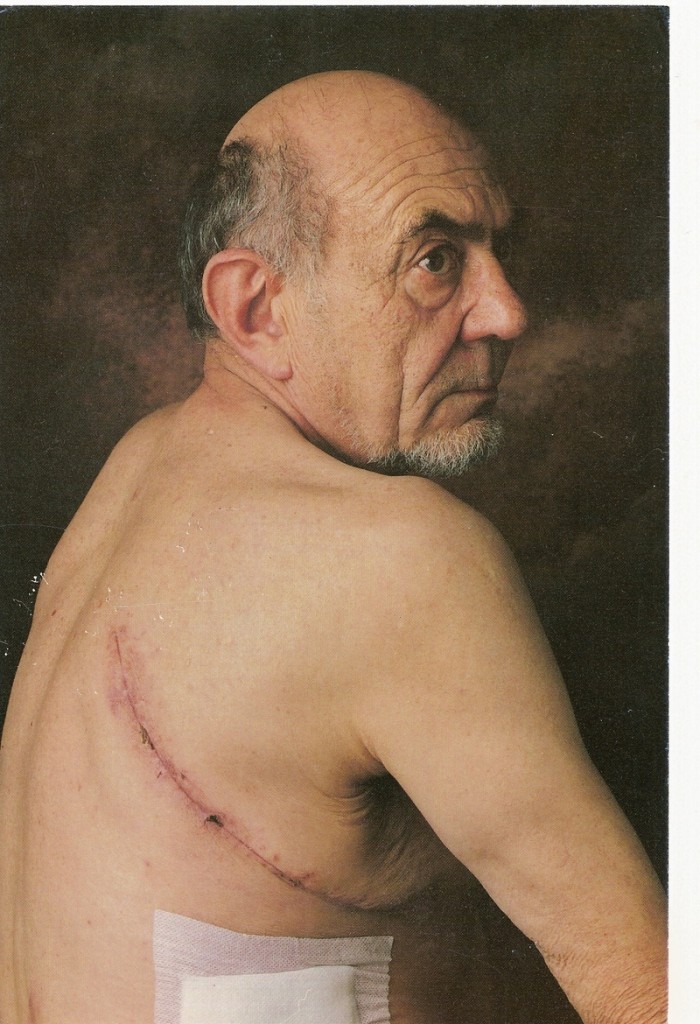

Almost half the cigarettes sold in the United States come from Philip Morris International. Dividing that into the American Cancer Society’s figures, that means the company kills 217,000 of its own satisfied customers every year. (Of course, that’s a semantic mistake. The 217,000 kill themselves. Philip Morris only sells them the weapons.) That’s to say nothing of the myriads more around the world who die courtesy of Philip Morris cigarettes.

Philip Morris International pays a $3.08 dividend annually. That’s a 3.4% yield, which is excellent. (And remember that the lower that yield is, the higher the stock price is, which is not exactly a bad thing.)

Chick-Fil-A feeds people. A day without lunch is a miserable day indeed. Philip Morris International, even if its CEO were to register as a minister with the Universal Life Church just so he could marry as many homosexual couples as he can find, still sells death. His products have no worthy purpose, and do nothing to better the species nor our surroundings.

They’re also a fantastic buy. Philip Morris International has a diehard customer base, if you will, with hundreds of thousands of budding smokers waiting to take their place once the former check out. For every one who quits, plenty of others never do, taking their brand loyalty to the grave. Refusing to invest in the company that gives said consumers a reason to die is high-mindedness that leaves cash on the table.

Anheuser-Busch, too. Same thing. Last year, an $8 billion profit on $39 billion in revenue. Selling a product that numbs brain cells, impairs judgment and causes far more problems than it solves. Should we take the noble road and not purchase its stock?

Whatever for, if it continues to turn increased profits and pay regular dividends? It only does so because people like to get drunk. Millions of them. Are we going to do our best Carrie Nation, standing outside 1 Busch Place in our finest black bloomers, espousing the moral rectitude of temperance? Doing so wouldn’t convince a soul. As long as smokers and drinkers (and chicken sandwich eaters to a lesser extent, although Chick-Fil-A isn’t publicly traded) want their fix, someone’s going to get a cut of it. Why not you?

If your answer is “because I’m better than that”, good for you. We’ll let you know when your local organic yoga mat workshop does its IPO.