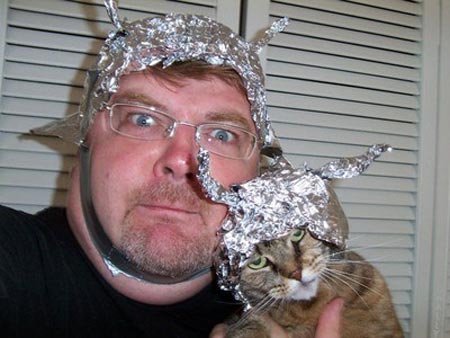

Timothy and Mr. Fixins get a little testy when their Carnival of Financial Planning isn't served up just right

It’s carnival time at Control Your Cash, yet again. This week’s is the Carnival of Financial Planning, courtesy of the thorough and endlessly professional Larry Russell at The Skilled Investor. He’s the one who slaved over this meal in a steamy kitchen (after selecting all the ingredients), then arranged it on the plate; all we’re doing is serving it.

Anyhow, the Carnival of Financial Planning is different than most carnivals in that it takes a long-term view of personal financial planning. As Larry puts it, “we focus on efficient and sustainable personal financial planning practices that can lead to lifetime financial security.”

And he even organized it! “This edition is arranged by subject heading, so that you can browse efficiently.” So let’s get started, shall we?

Budgeting and Economics

Craig Ford presents Groupon and Living Social Get a Yellow Light posted at Money Help For Christians, saying, “With all the hype about Groupon you need to know that there is a potential downside.” Not as big as the downside of Groupon CEO Andrew Mason turning down $6 billion from Google, but shocking enough.

Matthew Paulson presents Get Your Financial House in Order with These Five Personal Finance Audio Books posted at Audiobooktopia. (Note: Did you know that the Amazon Kindle does text-to-speech, essentially making every book an audiobook? The Amazon guy’s voice sounds like Joe Buck on lithium, but it works.)

Estate Planning

My Journey presents What is Portability in Estate Planning? posted at My Journey to Millions. He explains: “There were a lot of tax law changes (as well as a lot of things that were kept the exact same) when President Obama signed into law the Unemployment Insurance Reauthorization and Job Creation of Act of 2011, but there was one change that simply put, shocked me. It was the brand new idea that your Credit Shelter Amount was Portable.”

Financial Planning

Tarik Alsharafi presents Be wealthy today – by cutting your paycheck in half.. posted at Success starts today, saying, “To be wealthy every day of your life, you need to have some savings aside. It is simply not easy to go day to day without any money saved. Even $100 is enough to start with. Don’t have even that? Start with $1. You don’t have to be financially free to feel wealthy, you need to have a sound financial system in place to be wealthy. Learn to save money, invest it, and reinvest it starting this month.” Fortunately for Tarik, sensible habits count more than punctuation and spelling do.

Mike Piper has done it once more. The 6000th consecutive thought-provoking post at The Oblivious Investor is How Social Security Benefits Are Calculated. Mike says, “given that Social Security makes up a significant portion of retirement income for most US retirees, it’s worth knowing how your benefits are calculated.”

Frank Knight presents Portfolio Asset Allocation at Best Personal Financial Planning Software, saying, “When you are already there and invested in an asset class, you are following a passive asset allocation strategy. Tactical asset allocation strategy advocates suggest that you can anticipate the crowd, but flow-of-funds studies show that almost all tactical asset allocation fund flows are late money flows that chase performance after valuations have already moved.” It gets snappier, trust us.

Financing a Home

Jim Yih presents Time to pay down your mortgages at Retire Happy Blog. While we try to wrap our heads around the exceedingly complex organisms that are Canadian mortgages (“closed vs. open term”? “6 month/7 year”? And what’s a RHOSP, anyway?), Jim explains that “with the recent boom in Canadian real estate prices you can pretty much guarantee everyone is carrying more mortgage debt than ever.”

Financing Education

Outlaw presents How to Pay for College at Outlaw Finance, offering, as you might imagine, “tips for reducing the cost of education and planning for the remaining expenses.”

If paying even a nickel is still too demanding, Chetan presents How to Pay for College with No Money at College Distance Degree. Chetan colorfully tells us that “If you or your family is already struggling to make ends meet in this economy, trying to find a way to pay for college may be a daunting task.”

Kyle Berks presents Qualifying for Personal Loans after Bankruptcy Discharge at Integrated Loans, saying, “It is not easy to pick up all the pieces after a bankruptcy as well as qualifying for a personal loan, but despite the fact that it may not be easy, it is definitely not out of the question.” (Note: this post also featured in the Carnival of Curious Syntax)

Investing

A dividend husband, dividend wife, and their teenage dividend son and daughter walk into a talent agent’s office. They say, “We’ve got an act that’ll blow your mind.” Hussein Sumar presents S&P 500 Dividend Aristocrats of 2011 at Best Dividend Stocks, saying, “The S&P 500 Dividend Aristocrats Index is the most honorable list of dividend paying stocks as measured by the S&P 500 Index that have consistently increased their dividends for the past 25 years, without missing a single dividend payment.” We trust you’ll find the list honorable too.

Jessica presents TIPS: Treasury Inflation Protected Securities at MomVesting. She acronymically puns, “people love to give financial tips, but taking them can be risky. There are, however a different kind of TIPS that can have a place in many portfolios.”

Your “host guest” at The Skilled Investor presents Market Timing posted at Personal Investment Management, wisely stating that you should “Always stay invested to earn risk premiums. You must have your money invested and at risk to get risk premium returns. Jumping out and in or ‘timing the markets’ doesn’t work.”

Walter Bruening of Great Falls, Montana died this week at 114.

True story: the local newspaper would interview him annually once he got to like 103 or something. One year the reporter asked, “What’s your earliest memory?” His response:

“When I was 5, I got my first real haircut. My father took me to the barbershop, and I remember it because everyone was talking about the shocking news: the assassination of President…

McKinley.”

False story: Mr. Bruening won a structured settlement last month.

He didn’t, but if he had that’d be the ultimate in deferred gratification. That being said, Dividends4Life presents 8 Dividend Stocks For The Ultimate In Deferred Gratification at Dividend Growth Stocks, saying, “Deferred gratification is a principle where one or more people choose to postpone near-term benefits in order to enhance their chances of greater benefits in the future. In our microwave society marked by the ‘I want it now’ attitude, it is unusual to find someone willing to wait.” So now you know what deferred gratification is.

Frank Vertin presents Top Index Funds at Index Mutual Funds, where he showcases “(the) top ten no load index funds that track the Standard and Poors 500 composite index in terms of lowest costs.”

FMF presents Being an Active Investor is a Lot of Work at Free Money Finance, saying, “Do you really have enough time to be a successful active investor? It takes much more time (and effort) than many people can (and will) dedicate to it.”

Managing Credit and Debt

At our favorite blog named after a soybean oil spread, Jeff Weber presents April 2011 Balance Transfer Credit Card Report at Smart Balance Transfers, saying, “In April, credit card companies offered average 0% introductory rates on balance transfers lasting more than 12 months, marking the first time this average has eclipsed the one year mark since inception and a good oportunity for consumers to save money.”

N.W. Journey presents the cryptically titled How to Order a Free Copy of Your Credit Report at Networth Journey, calling it “An easy to understand article on how to get your credit score.”

Jeri Ford presents Newbie FAQs About Credit Card Churning and Sign Up Bonuses at Help Me Travel Cheap. According to Ms. Ford, if you’ve “got questions about credit card churning? I’ve got answers.”

ComplexSearch presents What Is A Good Credit Score To Buy A House at Deals & Tips, saying, “Seeking out a good mortgage can be a complicated process, especially these days when lenders are much more stringent with their lending requirements than they once were. Learn what makes lenders say yes…”

Khaleef @ KNS Financial presents Back To Basics: Learn How To Save at Faithful With A Few. Khaleef points out that “How to save money is something that just about everyone wants to discover. However, we often bypass the simple in search of the complicated. Let’s get back to basics”

Tim Chen presents NerdWallet’s Best College Student Credit Cards, Spring 2011 Edition at NerdWallet Blog – Credit Card Watch, saying, “Rewards, 0% APR introductory periods and no annual fees are not solely the province of adult credit cards.”

Boomer talks sense. (And by “talks sense” we mean, “says something we’ve been hammering here at Control Your Cash for years.” He presents Why You Shouldn’t Care About Credit Card Interest Rates at Boomer & Echo, saying, “If you don’t carry a balance on your credit card, why should you care about the interest rate?”

Miscellaneous

“Dude, can I borrow like $200? I saw this bitchin’ set of speakers. I’ll totally pay you back with my next check.” Ever heard a variation on that? Then read Joe Plemon. He presents Your Friends and Your Finances: For Better or For Worse? at Personal Finance By The Book, saying, “How do your friends affect your finances? How do you influence them? This post will challenge you to consider what friendship is all about.”

If Yngwie J. Malmsteen needs an identifying middle initial, then we can also indulge Walter W. Fouse, who presents Large Cap Funds at Best Mutual Fund. Walter W. says, “This table of low cost top 10 S&P 500 mutual funds has been organized with the lowest cost index fund first. Nevertheless, each of these S & P 500 index funds is among the least costly on the market.”

BIFS (and all this time we’ve been calling her “BITFS”) presents The Jung Typology Test – Personality Test Results | Budgeting In the Fun Stuff at Budgeting In the Fun Stuff. She says, “One important key to properly planning ahead is understanding yourself and your abilities. When you know yourself and how you will behave, you can plan around that and it will be much easier and more effective when you follow through.” As for planning after, you’re on you’re own.

Anjum presents Non-Profit Management Programs: MA vs MPA vs MBA » Masters in Nonprofit Management at Masters in Non-profit Management. He helpfully explains that “The non-profit sector includes charities, conservations groups, religious organizations, zoos, and more. Managing non-profit organizations is very different from managing a typical business, so there are specific graduate school programs available to those interested in working in leadership positions in this field. If you’re interested in a master’s degree in non-profit management, you have three main options: an MA, an MPA, or an MBA.”

Pasadena Financial Planner presents Vanguard Funds at Top Mutual Funds, saying, “Compares Vanguard’s actively managed mutual funds and Vanguard’s passively managed index mutual funds. Vanguard investors should read and understand this study.”

Retirement Planning

RJ Weiss presents Choosing Between a Traditional versus Roth IRA at Gen Y Wealth, saying, “The purpose of this post is to compare the two types of IRAs for individual investors. In addition, offer guidelines for making the optimal choice.”

retirebyforty presents Roth IRA at retireby40.org, saying, “Roth IRA is a great investment vehicle. April 18th is the last day to file the 2010 tax return and you can still contribute to the 2010 Roth IRA if you haven’t already done so.” So set your clock back 96 hours and check it out.

It’s an FMF doubleshot! Two for Tuesday on a Friday! He presents Retiring Overseas at Free Money Finance, saying, “Ever thought of retiring overseas? Turns out many people have (and it’s becoming more common.) This post gives some thoughts on how to make this idea a reality.”

Jim Wilkerson presents No Load Mutual Funds at Best No Load Funds, saying, “Very young stock and bond mutual funds are more likely to put you into the position of being an experimental guinea pig of mutual fund companies and the ETF industry.”

Tom presents What First? Pay Off Student Loans or Save For Retirement? at StupidCents. While we’re pretty sure we know the answer, Tom says “getting your feet wet in the real world seems to be consistent on every graduates radar. So what first? Paying off student loans or saving for retirement?”

Jareth presents Retirement Calculator at Retirement Software. In his trademark easy prose he writes, “Retirement investment calculator software automatically acts as a comprehensive compound investment calculator that applies historical investment return growth rates to your cash, bond, and stock assets.”

If there’s a more important question that this, we don’t know what it is. (Possible runner-up candidates include “What’s the meaning of life?” and “Why do NFL teams punt on 4th and short at midfield?”) Pinyo presents How Much Money Do I Need to Retire? at Moolanomy. According to Pinyo, “this article takes you through three easy steps to help you calculate how much you need to save for retirement.”

Savings

He’s Matt, bad, and dangerous to know. And we love him Mattly. Matt Bell presents Why Two Savings Accounts Are Better Than One at Matt About Money. To quote Matt, “Interested in dialing down your financial stress and making your finances run more smoothly? Open and maintain two savings accounts. Here are the two types of savings accounts everyone should have.” Don’t get Matt, get even.

Taxes

He can do for your taxes what Frank Jobe did for his ulnar collateral ligament. Tommy John presents Last Minute Tax Tips For Those Filing 2010 Taxes at 2010Taxes, saying, “These tips can make last minute tax filing a lot easier.”

Finally, Financial Freedom presents IRA Contributions at Retirement Worksheet. Read it and weep: “The Roth tax optimization puzzle for asset conversions, as well as for annual Roth contributions during working years, is one of the most complex decisions that the ridiculously complex US taxation and retirement planning system forces upon individuals.”

That concludes this edition. Submit your article to the next edition of Carnival of Financial Planning using the carnival submission form. You can find past posts and upcoming hosts on the blog carnival index page.