We’re still having this discussion?

Listen, the credit card companies don’t owe you a thing. You owe them. That’s how you got stuck in this mess, remember?

You applied for a card. You signed an agreement. No one “preyed” on you. Coyotes prey on ground squirrels. But the ground squirrels never initiated proceedings with the coyotes.

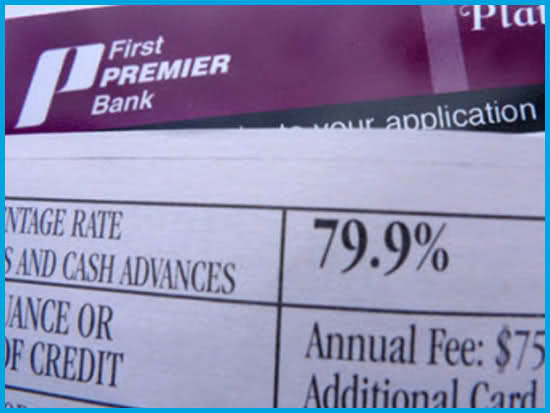

If a credit card company promised you a 7% interest rate, then started charging interest on your balance at 15%, then you can consider yourself preyed upon. Even though you’re idiotic for carrying a balance in the first place. One problem: no issuer has ever arbitrarily raised rates without notice. They’re not going to blatantly lie and run the risk of losing customers.

But they lost me, you say. I refuse to pay their confiscatory interest rates. I’ll never get out of this mountain of debt. Even the White House and Congress want to keep them in check, so clearly the issuers are doing something nefarious.

Then where’s the court willing to hear the inevitable class action suit filed on behalf of millions of defrauded cardholders? Fine, if you’ve got conclusive proof that a credit card issuer dishonored the terms of its agreement with you, let us know about it at info at control your cash dot com. Include a copy of the agreement.

Neither American Express nor Visa nor MasterCard nor Discover has ever held a cardholder at knifepoint and said, “Buy stuff, preferably more than you can afford.” Diners Club and Carte Blanche, we can’t vouch for. Ask your great-grandfather.

Governments routinely change the rules in the middle of the game, but do you seek redress for that? Your elected representatives and executive branch raise tax rates, and your only recourse is to emigrate. Which is somewhat less practical than cancelling a credit card.

In Control Your Cash: Making Money Make Sense, we endorse Discover and American Express Blue Cash as the only credit cards you should look at (and even then, pick only one of them.) Sure enough, the moment we sent the manuscript to the publisher, American Express unveiled a new card: Zync.

It’s got a contemporarily misspelled word and it starts with a Z…the young folks will love it! Zync is intended for people in their 20s and 30s, as evidenced by the patronizing marketing campaign. (Hey, that’s Control Your Cash’s demographic! Only we try to talk to you like adults.)

Anyhow, here’s how Zync works. You pay $25 annually, which immediately sounds like a bad idea, but keep reading. You have to pay the card balance every month. (Until the ‘90s, this was how every American Express card worked. The company made a lot of money on annual fees, and even more on services available only to cardmembers. Convince people that they’re special and you can rifle through their pockets indefinitely.)

On top of the $25, you can pay an extra $20 for what American Express calls a “pack”. “Packs”, just like the way they expand the video games.

Anyhow, packs: (This feels like explaining Twitter to my grandmother.) The Go Pack, the Social Pack, the Connect Pack, the Eco Pack. That pretentious-sounding last one waives the $20 fee, because encouraging something as noble as global-mindedness should never come with a price tag.

The Go Pack earns you double rewards on airfare, an annual $50 credit if you book a vacation via American Express (don’t, Orbitz is free), 20% off Hertz car rentals, and 25% off Avis and Budget. (We’d love to know which Hertz employee stood firm on that 20%. Don’t kid yourself: they really are #1.)

Then there’s the Social Pack (social, like networking! This isn’t your grandfather’s credit card.) Double rewards at restaurants and shows, and first crack at seats for the latter.

Followed by the Connect Pack. Double points on your cell phone, cable and internet service; and you get 1/3 more points on cell phones at MembershipRewards.com.

For the insufferable among you, and those who just happen to prefer the illusory to the tangible, get the Eco Pack and American Express will buy $1 of carbon offsets. Amass enough of them, and you too can get a Sri Lankan farmer to metaphorically dig himself an early grave by continuing to plow his yam fields with oxen and a hand tiller instead of saving up for a tractor. As if that’s not enough, you’ll earn double reward points on any item deemed sufficiently holy by American Express’ green-rating service. This includes Chevy Volts, Olive Green loofah dog toys, Aleutia solar-powered desktop computers (we’d never heard of them either), and other stuff we wouldn’t be caught dead buying.

You know what were the first companies to offer reward points for buying more of their product than was good for you? Cigarette manufacturers, and not by coincidence.

American Express gives you “one point for virtually every dollar you spend.” So charge $432,000 to your Zync card, and you can earn a 17” MacBook Pro with a 2.8GHz Intel Core Duo processor, which is a wonderful computer that retails for about $2000. Of course, this assumes you haven’t redeemed any of your reward points for anything else in the time it takes you to spend that much.

Don’t be confused by the hijacking of a word. A “reward” is what you get for lassoing the horse thief to the cactus and holding him there for the sheriff. Credit card “rewards” are really incentives. They’re encouraging you to buy a particular product or service that you wouldn’t have otherwise.

You don’t want that. You want cash. (You really want gold or real estate, but credit card companies don’t offer those.)

So does Zync make sense? Only if you’re in that small group of people who know you’re going to rent $225 worth of car from Hertz this year (or $180 from Avis or Budget.) American Express’ own Blue Cash is a better deal. Blue Cash is not only free, it refunds you $1 for every $200 you purchase. Once you buy $6500 worth of stuff with it every year, they’ll refund $1 for every $80 you spend. You’d have to spend “only” $163,900 to earn that MacBook Pro. Which you should buy on eBay anyway. To paraphrase AC/DC, sink the Zync.

Fortunately, we don’t have to change one word of credit card advice in Control Your Cash: Making Money Make Sense. (And while you’re here, scroll up and to the right and buy a copy or two of our still up-to-the-minute book.)