The Dow Jones Company creates dozens of indices. By far the most recognized and quoted of those is its Industrial average, 30 stocks that are supposed to comprise a representative cross-section of the American economy. Dow’s 2nd– and 3rd-most noted indices are its Transportation and Utilities averages, one of which we’ll discuss today and the other we’ll talk about Wednesday unless something more exciting comes along.

First off, why is the New York Stock Exchange stuck in the 19th century? Why “Industrials”, “Transportation” and “Utilities”? Shouldn’t they have given way to something like “Telecommunications”, “Software”, and “Health Care” by now?

Well, because industry (however you define it), moving stuff and people around, and keeping the lights on are still pretty important.

The Transportation index was created 129 years ago. Originally it was nothing more than the total of the stock prices of 9 railroad companies, a steamship company and Western Union. With the exception of Western Union – which is now exclusively in the business of transferring money – and Union Pacific, every one of those companies is defunct.

Of course, Dow Jones added and subtracted other companies to and from the index over the years. Much like its Industrial counterpart, the Transportation index consists of the prices of several (30 for Industrials, 20 for Transportation) stocks, summed and multiplied by a constant. The Transportation companies are as follows:

- 5 airlines

- 4 trucking companies

- 4 railroads

- 3 deliverers

- 2 shippers (as in ships)

- 1 rail lessor

- 1 truck lessor.

The airlines, you’re probably familiar with. Delta, United, Southwest, JetBlue and Alaska, which are respectively America’s 1st-, 2nd-, 3rd-, 6th– and 7th-largest by passenger volume. 4th is American, which filed for Chapter 11 last year and was thus replaced on the index by Alaska. 5th is US Airways, which filed for bankruptcy in 2001 and again 3 years later.

The trucking companies have a more direct effect on your life than the airlines do, yet it’s doubtful you’ve heard of more than a couple.

C.H. Robinson, based in the Twin Cities, is what they call a “3rd party logistics” company. They don’t actually own trucks, but instead agree to ship customers’ freight using other companies’ trucks. And ships and planes. Also railcars, which C.H. Robinson does own. But the vast majority of C.H. Robinson’s revenue, $7 of every $8, derives from trucking. Landstar, headquartered in Jacksonville, is similar to C.H. Robinson in that it doesn’t own vehicles. Two of the other trucking companies, Ann Arbor, Michigan’s Con-Way and J.B. Hunt (based in Northwestern Arkansas), you’ve seen proof of up close if you’ve ever driven on an interstate.

The 3 delivery companies probably need no description, or at least 2 of them don’t – FedEx and UPS. The 3rd one is Expeditors, a Seattle-based company that specializes in international cargo shipments. (Is that redundant? “Cargo shipments”? Could we just say “cargo”? And why do shipments often involve a car while cargo involves a ship? Also, why do we park on a driveway and drive…)

The railroads on the Dow transport cargo, rather than passengers, because a) there’s a government-mandated passenger railroad monopoly in this country and b) that monopoly loses obscene amounts of money. They include the nation’s largest railroad (and, as we pointed out, the only one that’s been on the DJTA since Day 1) –Union Pacific, which is headquartered in Omaha. If you live east of the Mississippi, you’ve probably never heard of Union Pacific. Trust us, it’s huge. Vice versa for Jacksonville-based CSX, whose operations transverse the eastern United States and select parts of Ontario and Quebec. Crossing much of the same territory is Norfolk Southern, which covers the eastern states save New England and Florida, and whose western terminus is in Kansas City. Speaking of which, Kansas City Southern is the final railroad, with operations in the south central United States and much of central Mexico.

The two shipping companies are Matson and Kirby. Matson, based in Oakland, has one core and lucrative business – shipping stuff to and from Hawaii. Matson also ships to Guam, Micronesia, and a few ports in China. Kirby, with operations based in Houston, is the nation’s premier tank barge operator. They transport oil throughout the Mississippi and its tributaries, along the Gulf Coast, and to Alaska and Hawaii (the freak states.)

That leaves two, including the rail lessor, Chicago’s own General American Transportation. They lease railcars throughout the U.S. and Europe, and operate American Steamship, which crisscrosses the Great Lakes.

The truck lessor is Ryder, based in Miami. Yeah, they rent trucks, but they’re also “a FORTUNE® 500 provider of leading-edge transportation, logistics and supply chain management solutions. “

(God, does anyone working in the communications department of any major corporation know how to, y’know, communicate?) That means Ryder leases commercial fleets. The company also manages warehouses and drivers for companies that own their own trucks but want someone competent to handle the (sigh, hate this phrase) “supply chain”.

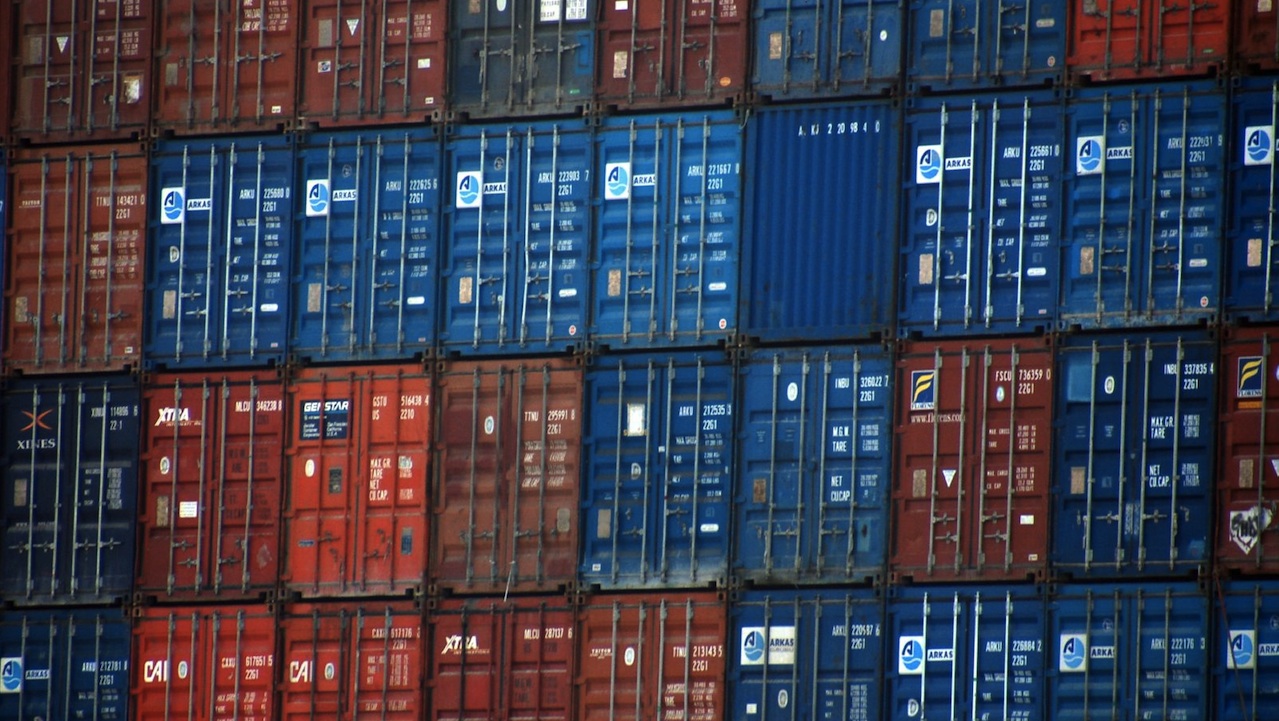

Which ones should you invest in? Primarily Kirby, but that’s not the point. We’re just trying to avail you a little of how a lot of the stuff you take for granted helps the economy roll. As the XXL t-shirt says, “If you bought it, a trucker brought it”. And picked it up off a dock where it was delivered by a container ship that was loaded from a railroad.