This bears revisiting, yet again. 88 weeks ago we encouraged you to look at the “rising” price of gold from a different, opposite perspective.

Why is “rising” in quotes? Because it implies that gold is getting more expensive, when technically all it means is that it takes more dollars to buy the same amount of gold than it did previously.

No, that’s not splitting hairs. It’s a distinction with a gigantic difference. Again, it takes more dollars to buy the same amount of gold than it did previously. In other words, each dollar now buys less gold.

Why do we assume that it’s the dollar that’s the consistent source of value and the gold whose price is deviating from some norm, rather than the other way around? Especially since the supply and inherent value of gold are far less subject to political pressure and artificial maneuvering than are the supply (and inherent value) of the dollar?

We proposed that instead of quoting the price of a fixed quantity of gold in dollars, we quote the price of a dollar in the corresponding amount of gold. Hence a new makeshift currency, the Aumg (milligram of gold.)

For instance, as of this writing the price of gold is listed as $1830 per ounce. Using the reciprocal of that, a dollar is thus worth .00056 ounces of gold. Clearly ounces are unwieldy units to use here, so instead we use milligrams. There are 31,103 milligrams in a troy ounce*, therefore a dollar is worth 17 Aumg.

Which means nothing on its own. Instead we have to look at comparisons over time and across currencies.

When we first devised this idea, the dollar was trading at 30 Aumg.

Last November, it was down to 22 Aumg.

And in 1968, it was worth 883 Aumg.

It’s not as if gold suddenly got less plentiful over the last 43 years, or even the last 43 weeks. The world’s gold reserves didn’t exit the atmosphere and head for Venus. It still takes unbelievably long man-hours and prohibitively expensive capital investments for mining companies to dig gold out of the ground and turn it into something shiny and marketable. That’s part of the reason gold has been such a constant source of value throughout human history: unlike oil, natural gas, pork bellies or other commodities, the annual output of gold stays consistent (and low, especially relative to what’s already been mined.)

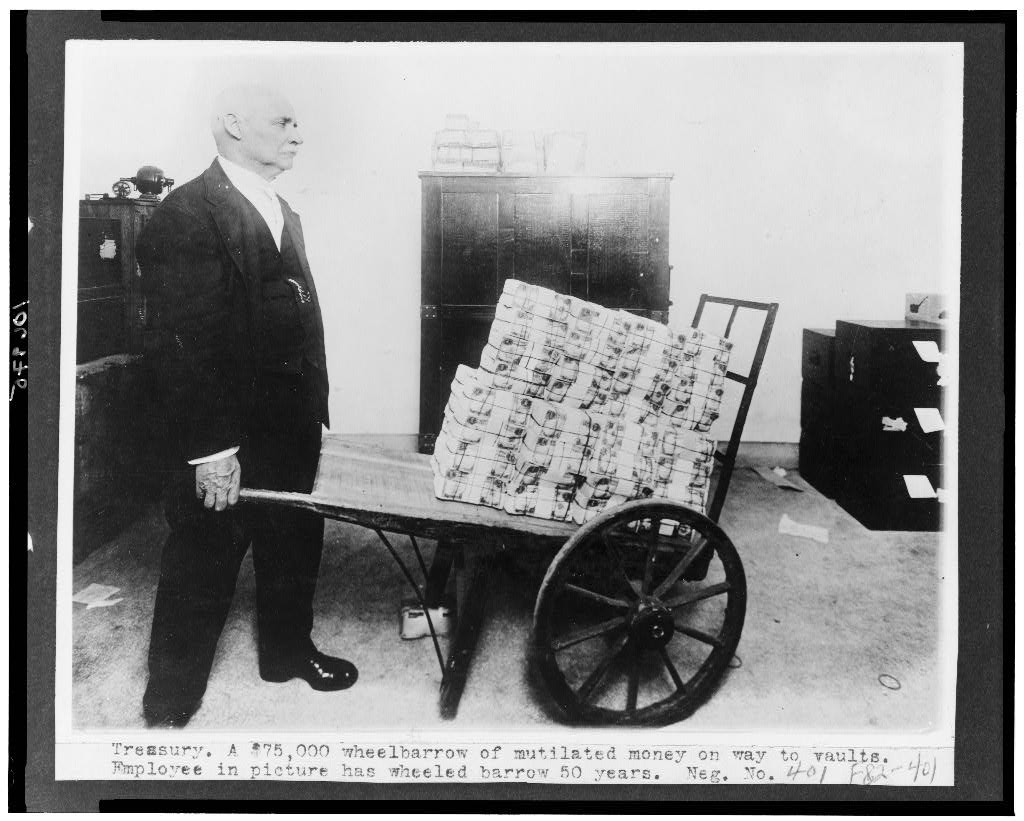

Dollars are a different story. First off, they’re artificial. They’re an arbitrary representation of value, created and put into circulation by a government that controls all the printing presses. Not to go Montana Freeman on you, but even the most ardent monetarist in the world would have to concede that. It’s a fact, not an opinion. And because dollars are imaginary, there’s no limit to the number of dollars the government can create. If Federal Reserve Chairman Ben Bernanke orders the Fed to create $38 octillion, it can and will. The number isn’t even limited by the amount of paper and ink available: all the Fed would have to do is increase the denominations.

Dollars are imaginary, but that doesn’t mean they’re worthless. (You can place an ad on the ControlYourCash.com sidebar, and we’ll take dollars as payment. At least for now.) But look at the numbers above if you don’t believe they’re a declining source of value.

So who cares? Prices rise, wages rise correspondingly. They’re just numbers, right? My grandparents bought a house for $40,000, but it still represented 4 years’ wages like a similar house would today. What’s the problem?

The problem is that the government owes money. Lots of it. To future retirees, to foreign governments, etc. The federal debt is the largest dollar figure regularly quoted in the media. Either those bills need to be paid, or the government must default.

Government “of, by and for the people” means that 1/300,000,000 of that debt is yours. If that sounds overwhelming, you can thank the representatives and executives you chose to represent you.

Those payments are quoted in dollars. An insolvent government has every incentive to weaken the value of each dollar it owes. It does that by printing more of them, making each dollar worth fewer and fewer Aumg.

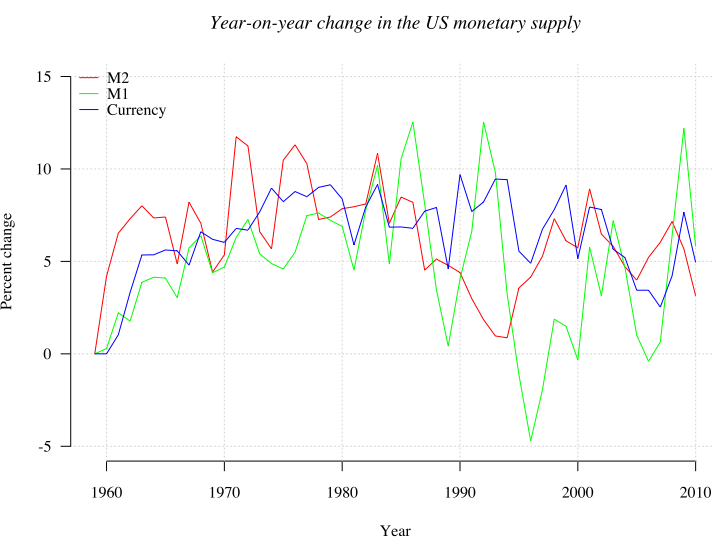

Here’s all the proof you need that the number of dollars in circulation isn’t close to keeping pace with the gold in circulation. Those annual increases in the money supply far exceed any increases in population.

What does this mean for you? Relative to the pound, the euro, and the Canadian dollar, the U.S. dollar might stabilize. It might even increase in value. But relative to gold, wagering on the dollar is a losing bet.

Unless that federal debt gets any smaller.

(Try to contain your laughter.)

*You know that childhood brainteaser, “What weighs more, a pound of feathers or a pound of gold?” The answer is the feathers. Metals are measured in troy weight, just about everything else is measured in avoirdupois weight. An “everyday” ounce is larger than a troy ounce, and besides, there are 16 avoirdupois ounces to an avoirdupois pound as opposed to 12 troy ounces to a troy pound.

**This article is featured in Totally Money Carnival #36: Football is Back Edition**