Every week we host the Carnival of Wealth which, although it features content written by other people, requires us to work harder than we do to write one of our own posts.

This week we received a submission from Flexo, the guy who runs Consumerism Commentary. When we started CYC, Flexo was one of the first established personal finance bloggers to accept a guest post from us. He later made the unfortunate choice to let us guest host his own carnival. We gave it the CYC treatment, thus ruining our chances of him ever letting us host it again.

We didn’t run his Carnival of Wealth submission this week, but it did provoke enough thought that we’re devoting a blog post to it. His post, like several others we received, summarized a recent Pew Research Center study that made a shocking claim (all numbers quoted in 2010 dollars):

In 1984, the median net worth of households with someone under 36 in charge was $11,521.

In 2009, the comparable figure was $3,662.

Let’s temporarily leave aside the question of whether this superlative means what it says. The Pew Research Center adds irrelevant data to the study, so it can showcase its findings with respect to an agenda. Read the headline and subhead:

The Rising Age Gap in Economic Well-Being: The Old Prosper Relative to the Young

The median net worth of households with someone over 64 in charge rose from $120,457 to $170,494 during that same span, which is hardly remarkable. If you could travel back to 1984 and tell people about the $170,494 figure, it wouldn’t raise an eyebrow. The $3,662 one would raise plenty.

What old people have spent their lives socking away (and confiscating from younger people via the Ponzi scheme that is Social Security) isn’t germane. The median net worth of the young isn’t decreasing because of the old, and even Pew Research doesn’t dare make such a claim.

Still, a 68% reduction in median net worth is horrifying. Or is it?

- A lot of people currently under 36 are upside-down on their residences, a circumstance of the temporary phenomenon that is the depressed housing market. Those people’s 1984 counterparts had either bought houses and watched them amass value, or rented and lost nothing beyond what they were paying in rent.

2. In Pew Research’s own words,

…these long-term changes include delayed entry into the labor market and delays in marriage—two markers of adulthood traditionally linked to income growth and wealth accumulation

In other words, people under 35 are poorer than their Reagan-era counterparts because so many of the former are in suspended adolescence. They live at home longer, they play more enjoyable video games, they start college later and then they stay there longer.

The very next sentence, in which Pew reinforces its (and our) point:

Today’s young adults also start out in life more burdened by college loans than their same-aged peers were in past decades.

Well, yeah. Colleges discovered a while ago that they could almost name their own prices. It’s become received wisdom that you need a degree to flourish. (You don’t.) With a government bent on “making college affordable for all Americans”, a liberal student loan policy means that people without collateral can borrow amounts they can barely conceive of, let alone conceive of paying back. And why should they? It’s not their money, and it’s not their problem. It’s ours.

It gets better, and by better we mean worse. The data the Pew Group delivers antiseptically and devoid of judgment are the very reasons people are losing net worth. Here’s one reason Pew gives for the $3,662 figure:

…today’s young adults are more likely to be…single parents.

How about this: if you’re 25 and you want to raise a kid by yourself, or put yourself in a position where you might end up raising a kid by yourself, it’s going to hurt your financial situation. Your writer has a college degree and would be far too dumb to figure that out had he only graduated high school.

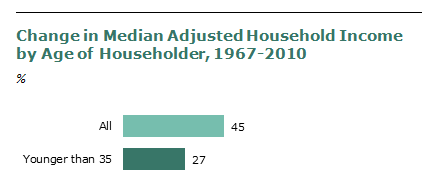

We don’t expect you to read the entire Pew article: frankly, we’re impressed you’ve stuck with this article as long as you have. But later in the narrative, Pew offers the following chart:

The same people whose net worths are decreasing are watching their incomes rise. How is that possible?

For one thing, Pew moved the start of the measurements back 17 years. Second, as we’ve expressed time and again,

Net worth is not income. Especially when Pew Research conveniently leaves this at the bottom of the page:

Following convention, this report’s wealth figures are measured at the household level and do not reflect any adjustments for the size of the household.

Hey now! 25 years ago, a household headed by an under-36-year-old likely meant one that included a married couple. Today, that “household” is more likely to mean one person. Hell, Pew said as much earlier in this jeremiad posing as a report.

More relevant details:

1984 was a recovery year following the 1981-82 recession, while 2009 could be construed as a recession year.

“Could be”? 1943 could be construed as a war year, too. Pew acknowledges that 1984 was in the middle of a boom, 2009 in a bust. Whether the economic cycle ought to have peaks as high and valleys as low as it does, the fact remains that it does and that Pew cherry-picked a bountiful year in the past and contrasted it with the worst recent year they could find.

Pew makes no mention of modern day young people’s materialism, which isn’t wrong in itself but is when it’s out of proportion to earning power. In other words, there were no iPads to finance with credit cards 25 years ago.

In summary:

How well old people live is not young people’s problem, nor vice versa.

Your house might not make you poor, but don’t count on it to make you rich, either.

Deferring adulthood, and productivity, will make you poor.

Spreading your legs/jettisoning your sperm costs money.

All things being equal, a household with x people is going to have a greater net worth than one with x-y people.

Everyone has an agenda.

This article is featured in the following carnivals:

**Top Personal Finance Posts of the Week – November 18, 2011**

**The Baby Boomers Blog Carnival One Hundred-nineteenth Edition**